RBA Cash Rate Announcement

- Fundwise Capital

- May 7, 2024

- 2 min read

At its third meeting for 2024, the Reserve Bank of Australia (RBA) kept the cash rate on hold at a 12-year high of 4.35 per cent.

Read today’s official statement on the RBA’s website. The board meets next on June 17-18.

Homeowners will no doubt be relieved about today’s decision, as hotter than expected inflation numbers caused many economists to predict a cash rate increase was on the horizon.

Michele Bullock, the RBA governor, has not ruled out future increases to the cash rate, stating that though the war against inflation “isn’t yet won”, and the risks to its outlook remain “finely balanced”.

While some economists have predicted further rate hikes are a near-term possibility, with potential cuts expected to occur at a slower pace, the latest Roy Morgan data reveals a stark reality: more than 1.5 million mortgage holders were at risk of mortgage stress in March 2024.

“Although inflation pressures have clearly eased, the level of inflation remains above the Reserve Bank’s preferred target range of 2-3 per cent and inflation indicators such as petrol prices remain high” Roy Morgan CEO Michele Levine said.

If you’re struggling with your mortgage repayments, it’s important to seek advice about whether your home loan is right for you.

As your mortgage broker, we can compare the market and explain what your options are, including whether there is a more competitive home loan with tools like interest-saving features that could help you get ahead.

Reach out today, and let’s discuss your home loan needs.

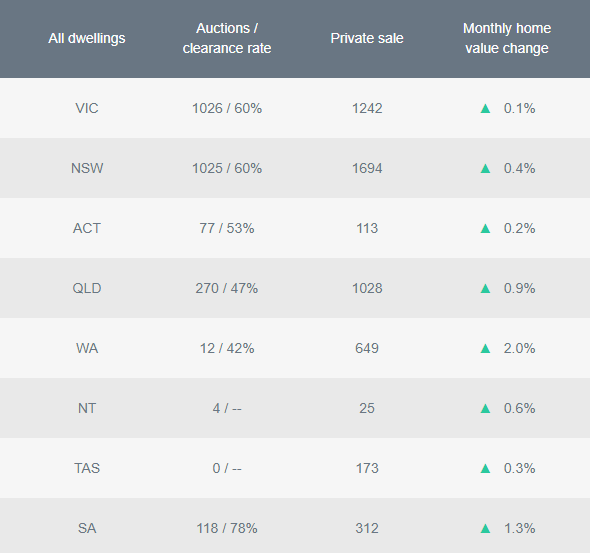

Property Market Snapshot

Need help understanding what this announcement means for you? Contact us today.

Kien Phan

518 Elizabeth Street | Melbourne, VIC 3000

t. 0487667788

.png)

Kommentare